The AI Compliance Software Built by Compliance Experts

We took 10+ years of compliance expertise and trained proprietary AI models to simplify compliance management and financial crime prevention.

199 users trust Regly

Our Solution

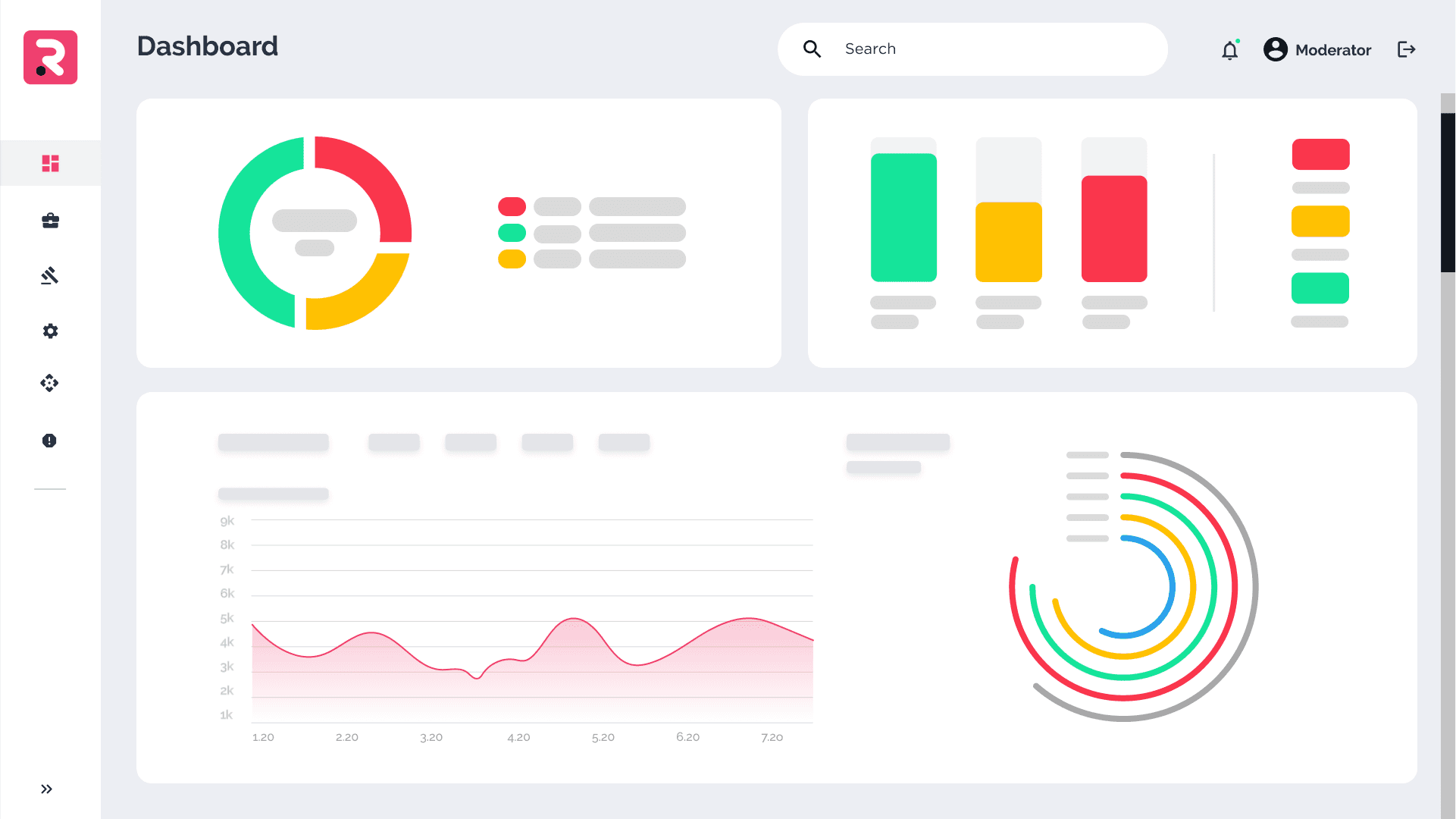

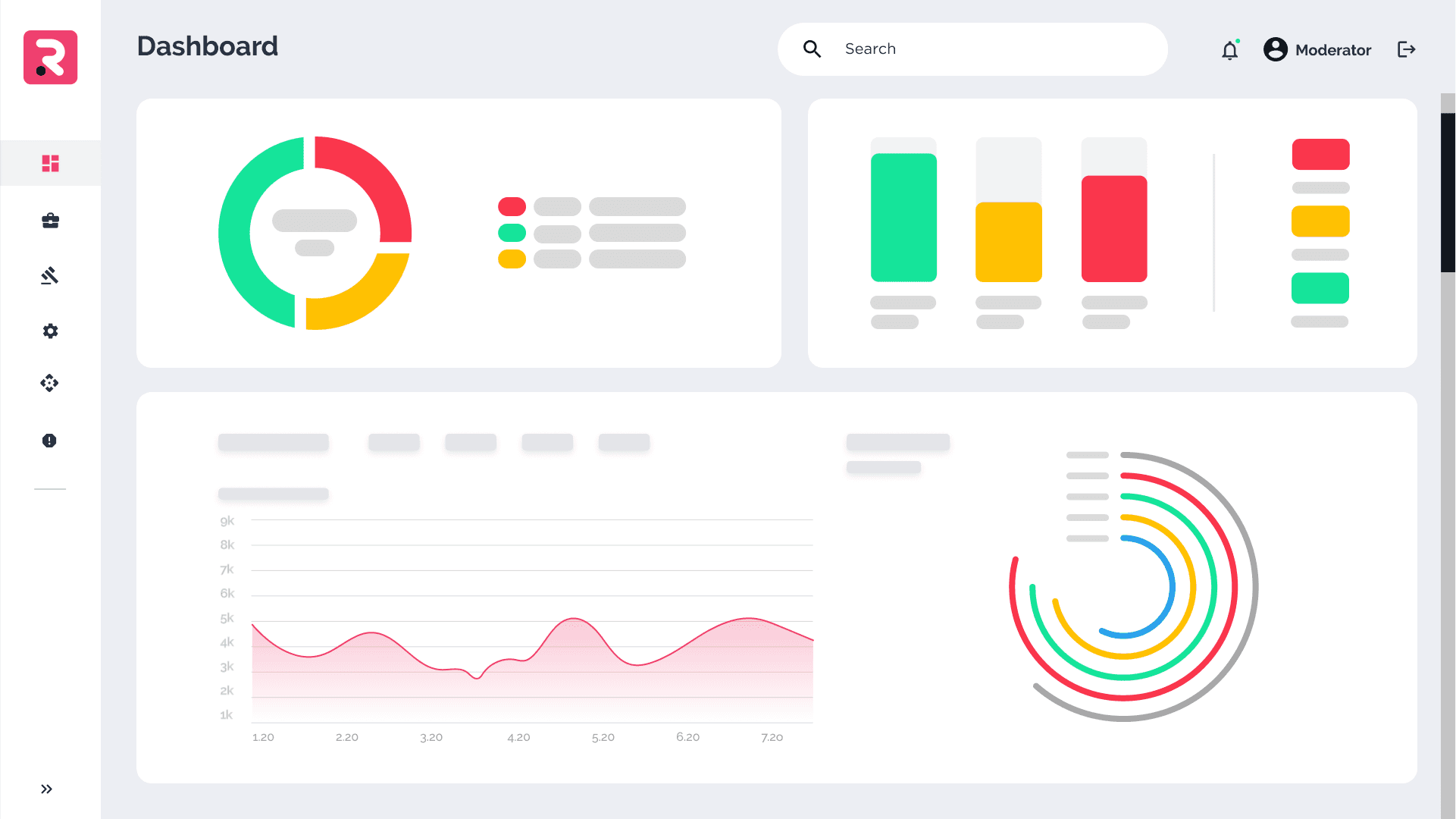

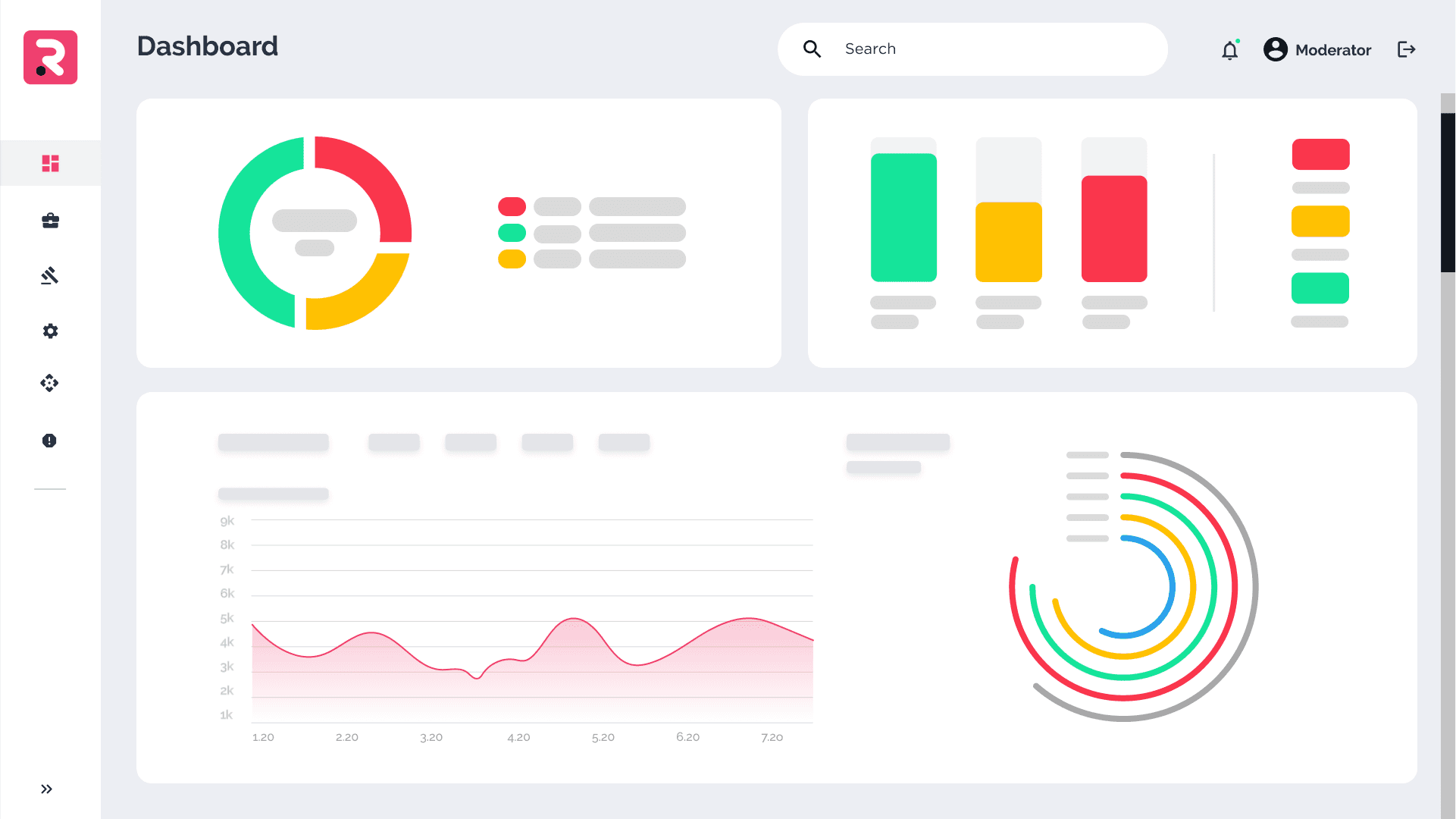

Simplify Compliance and Mitigate Risks

Regly combines advanced AI, automation, and expert-designed tools to simplify compliance and mitigate financial crime risk.

Team Collaboration

Team Collaboration

Work across teams with tools that simplify collaboration.

Work across teams with tools that simplify collaboration.

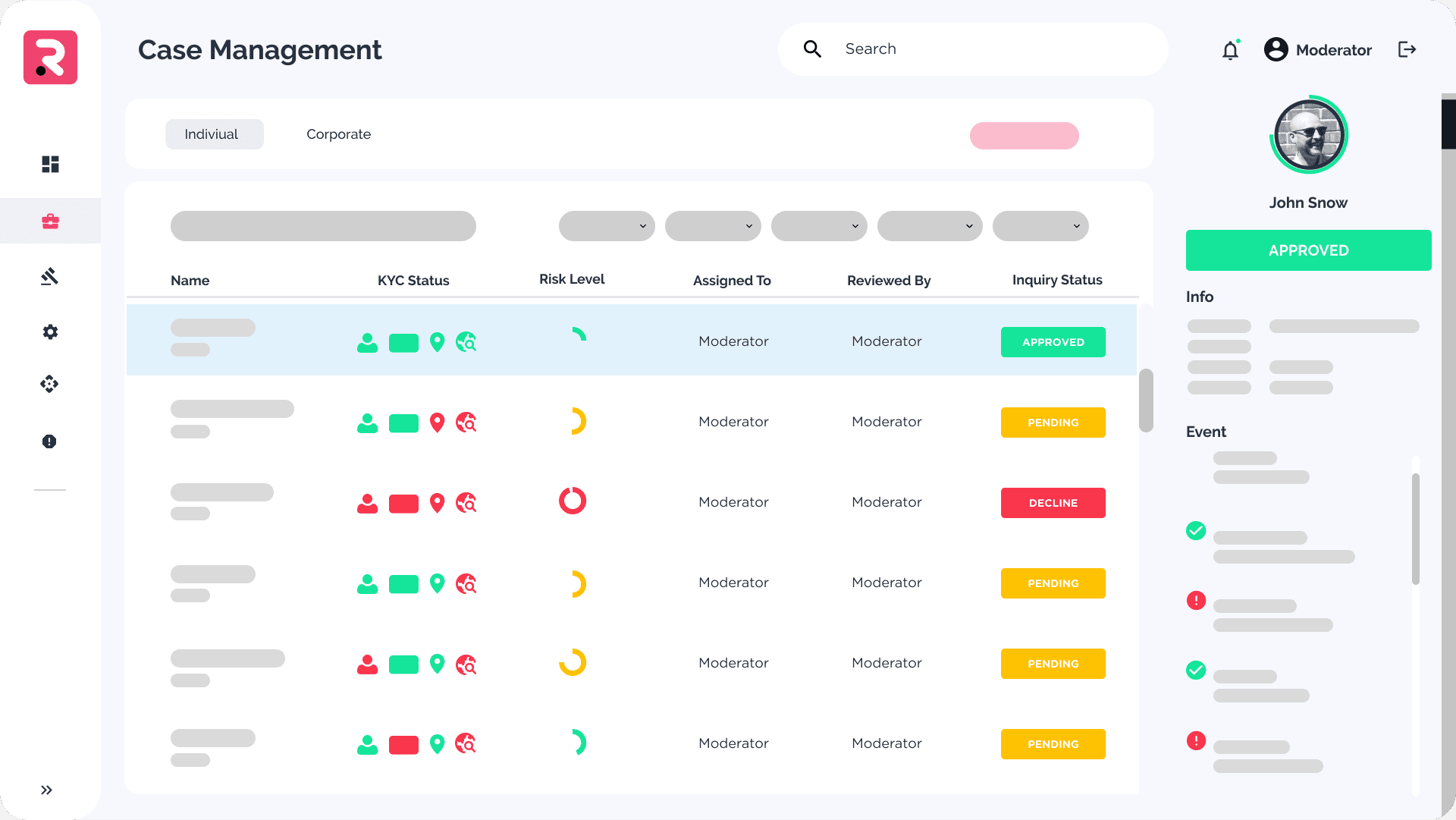

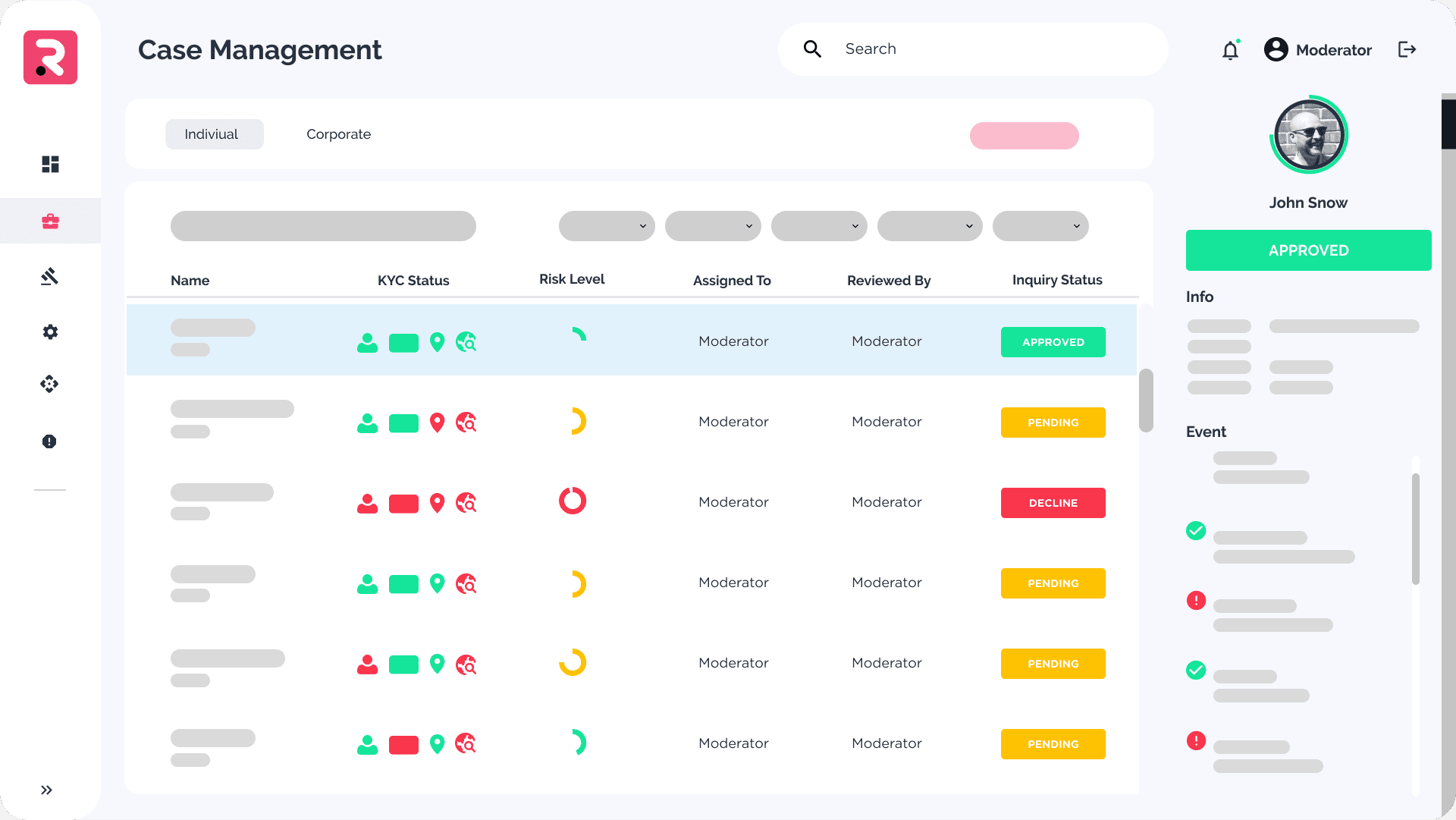

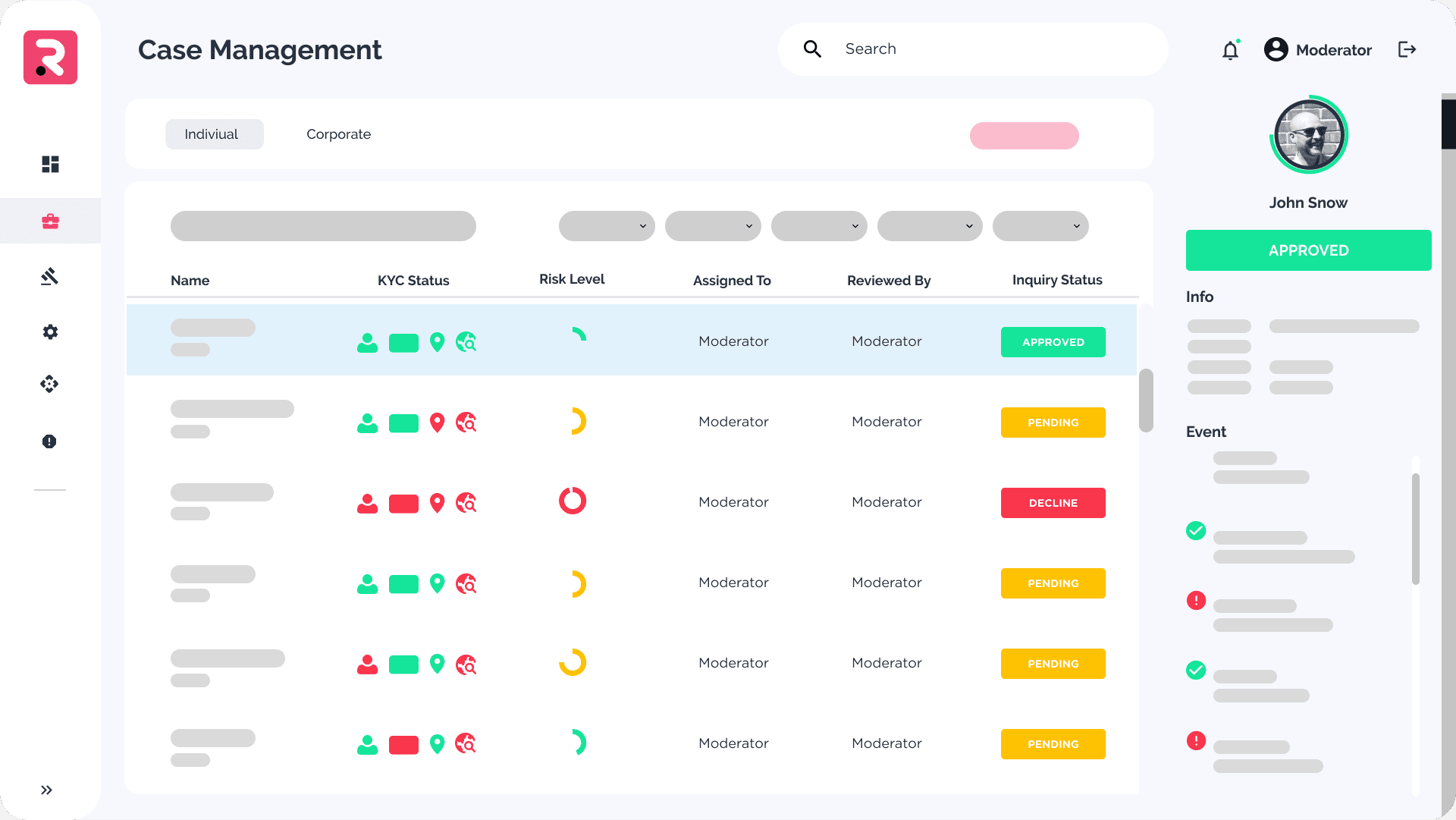

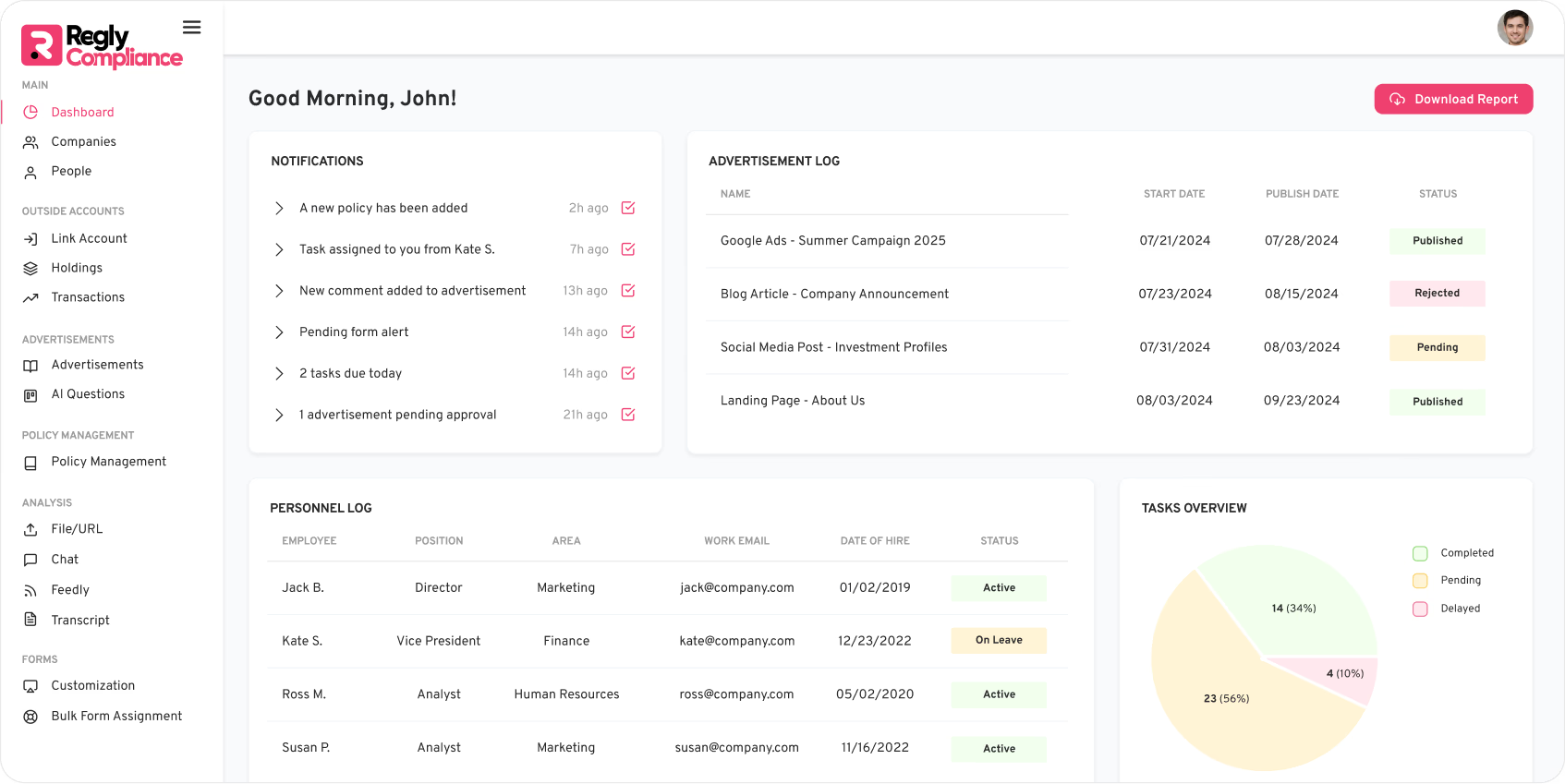

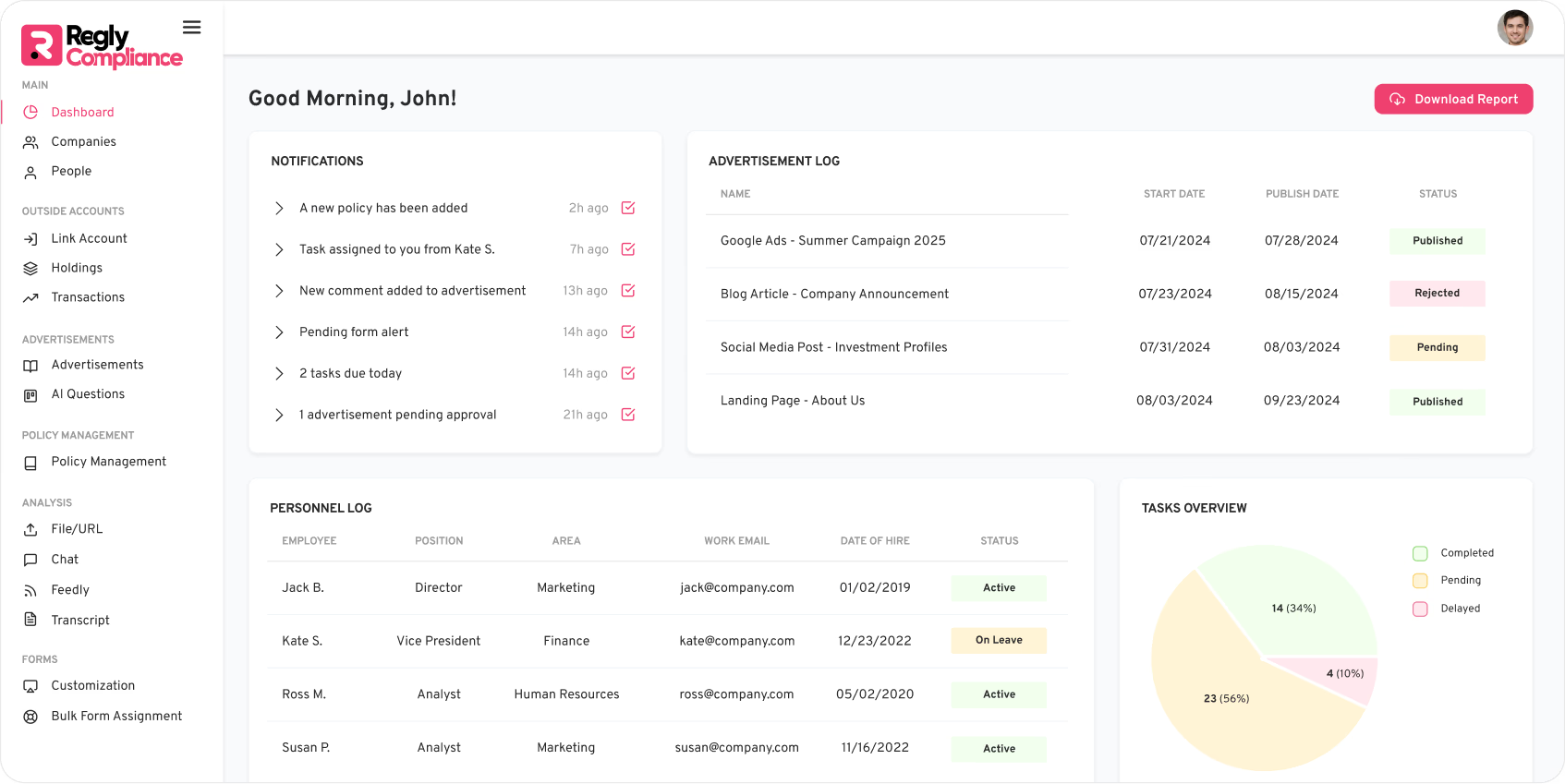

Centralized Compliance Workflows

Centralized Compliance Workflows

Easily manage your policies, forms, and approvals with a centralized software designed to streamline compliance workflows and boost efficiency.

Easily manage your policies, forms, and approvals with a centralized software designed to streamline compliance workflows and boost efficiency.

Automated Risk Detection

Automated Risk Detection

Proactively identify and address financial crime risks using intelligent AI-powered automation that simplifies complex and manual processes.

Proactively identify and address financial crime risks using intelligent AI-powered automation that simplifies complex and manual processes.

Scalable Solutions

Scalable Solutions

Adapt the tools to fit your processes and scale as your business grows.

Adapt the tools to fit your processes and scale as your business grows.

Our Advantage

Designed by Compliance Experts, Accessible to Everyone

Expertise in Every Feature

Regly is powered by 10+ years of compliance and financial crime prevention experience. Every feature is shaped by real-world challenges and designed by professionals who have worked through complex regulatory needs.

Expertise in Every Feature

Regly is powered by 10+ years of compliance and financial crime prevention experience. Every feature is shaped by real-world challenges and designed by professionals who have worked through complex regulatory needs.

Expertise in Every Feature

Regly is powered by 10+ years of compliance and financial crime prevention experience. Every feature is shaped by real-world challenges and designed by professionals who have worked through complex regulatory needs.

Smart Automation That Works

Say goodbye to manual spreadsheets and repetitive tasks that slow you down. Regly streamlines your workflows with automation tools that flag risks, generate reports, and simplify audits, saving your team hours of work every week.

Smart Automation That Works

Say goodbye to manual spreadsheets and repetitive tasks that slow you down. Regly streamlines your workflows with automation tools that flag risks, generate reports, and simplify audits, saving your team hours of work every week.

Smart Automation That Works

Say goodbye to manual spreadsheets and repetitive tasks that slow you down. Regly streamlines your workflows with automation tools that flag risks, generate reports, and simplify audits, saving your team hours of work every week.

Customizable and Scalable

Regly adapts to your business with pre-built rules, flexible features, and tools that grow with you. Whether you’re managing compliance processes or detecting financial crime, Regly makes it easier to stay compliant as you scale.

Customizable and Scalable

Regly adapts to your business with pre-built rules, flexible features, and tools that grow with you. Whether you’re managing compliance processes or detecting financial crime, Regly makes it easier to stay compliant as you scale.

Customizable and Scalable

Regly adapts to your business with pre-built rules, flexible features, and tools that grow with you. Whether you’re managing compliance processes or detecting financial crime, Regly makes it easier to stay compliant as you scale.

Tested and Proven Over Time

Regly’s processes, rules, and AI models were shaped by years of regulatory scrutiny while serving clients at InnReg. Every feature has been refined through real-world challenges to align with industry compliance expectations.

Tested and Proven Over Time

Regly’s processes, rules, and AI models were shaped by years of regulatory scrutiny while serving clients at InnReg. Every feature has been refined through real-world challenges to align with industry compliance expectations.

Tested and Proven Over Time

Regly’s processes, rules, and AI models were shaped by years of regulatory scrutiny while serving clients at InnReg. Every feature has been refined through real-world challenges to align with industry compliance expectations.

A compliance management software designed by experts who understand your challenges

A compliance management software designed by experts who understand your challenges

Marketing Compliance

Review marketing content with AI trained on real-world compliance challenges, and manage approval workflows to streamline the process while maintaining regulatory standards.

Marketing Compliance

Review marketing content with AI trained on real-world compliance challenges, and manage approval workflows to streamline the process while maintaining regulatory standards.

Marketing Compliance

Review marketing content with AI trained on real-world compliance challenges, and manage approval workflows to streamline the process while maintaining regulatory standards.

Policy Management

Simplify the creation, review, and distribution of policies with expert-designed workflows that reduce errors and keep teams up-to-date on your firm's procedures.

Policy Management

Simplify the creation, review, and distribution of policies with expert-designed workflows that reduce errors and keep teams up-to-date on your firm's procedures.

Policy Management

Simplify the creation, review, and distribution of policies with expert-designed workflows that reduce errors and keep teams up-to-date on your firm's procedures.

Employee Compliance

Manage forms, attestations, disclosures, and other personnel-related compliance tasks with tools designed to track progress and maintain transparency.

Employee Compliance

Manage forms, attestations, disclosures, and other personnel-related compliance tasks with tools designed to track progress and maintain transparency.

Employee Compliance

Manage forms, attestations, disclosures, and other personnel-related compliance tasks with tools designed to track progress and maintain transparency.

Vendor Management

Use artificial intelligence to consolidate vendor information, assess third-party risks, and track key documents, simplifying oversight and improving efficiency.

Vendor Management

Use artificial intelligence to consolidate vendor information, assess third-party risks, and track key documents, simplifying oversight and improving efficiency.

Vendor Management

Use artificial intelligence to consolidate vendor information, assess third-party risks, and track key documents, simplifying oversight and improving efficiency.

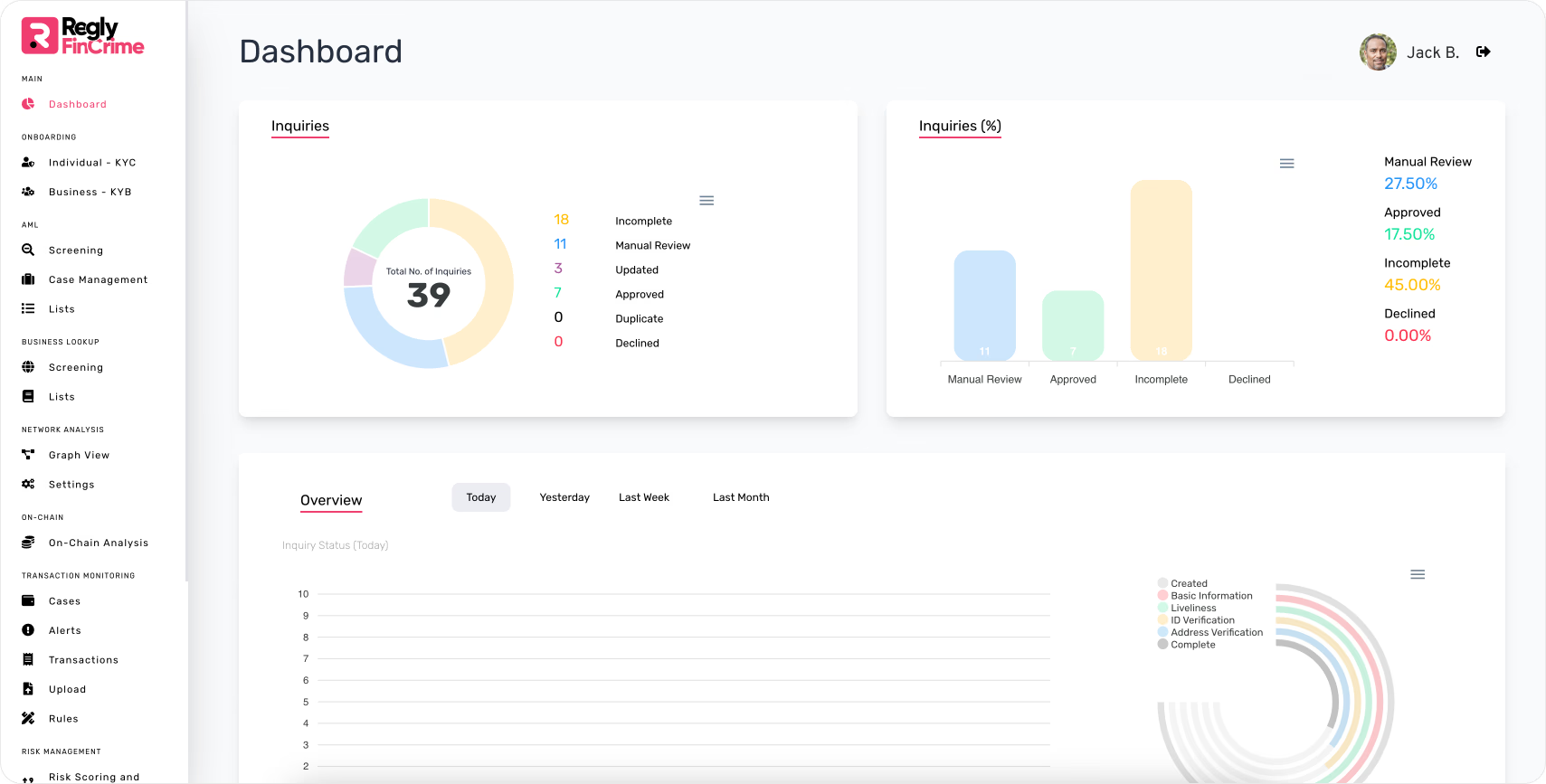

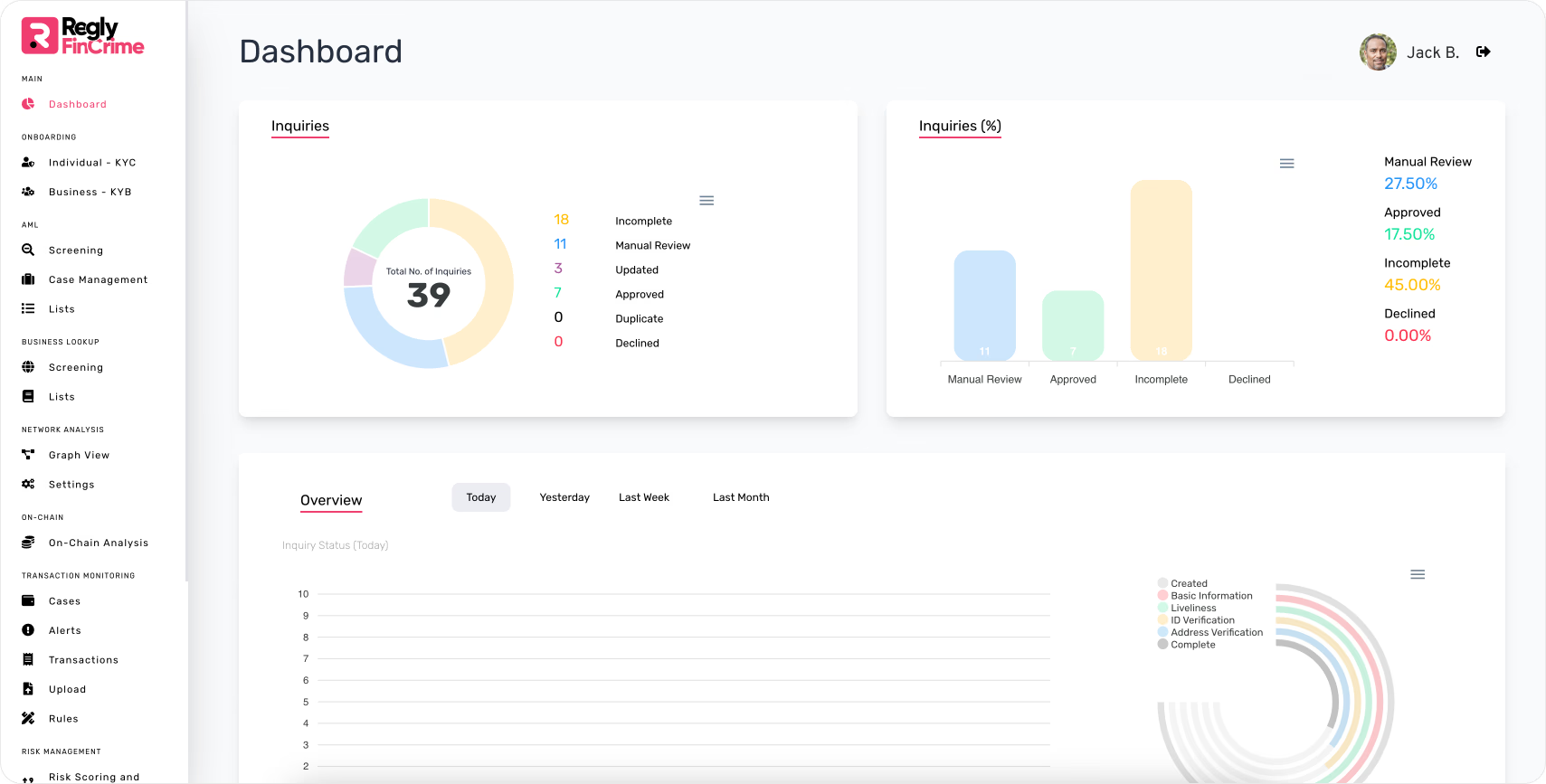

A compliance software designed to help businesses detect and mitigate financial crime risks, with AI-driven tools built by experts

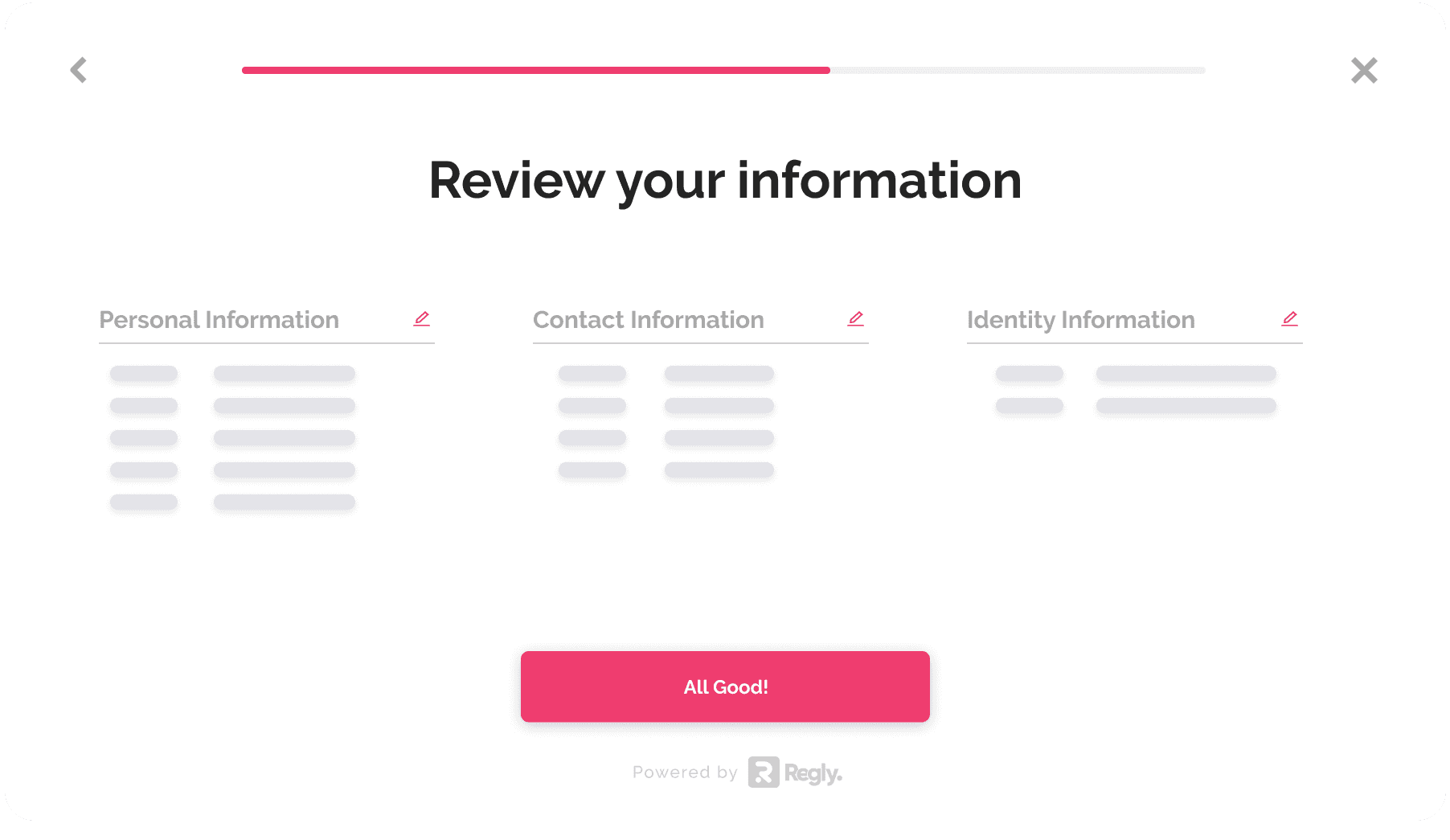

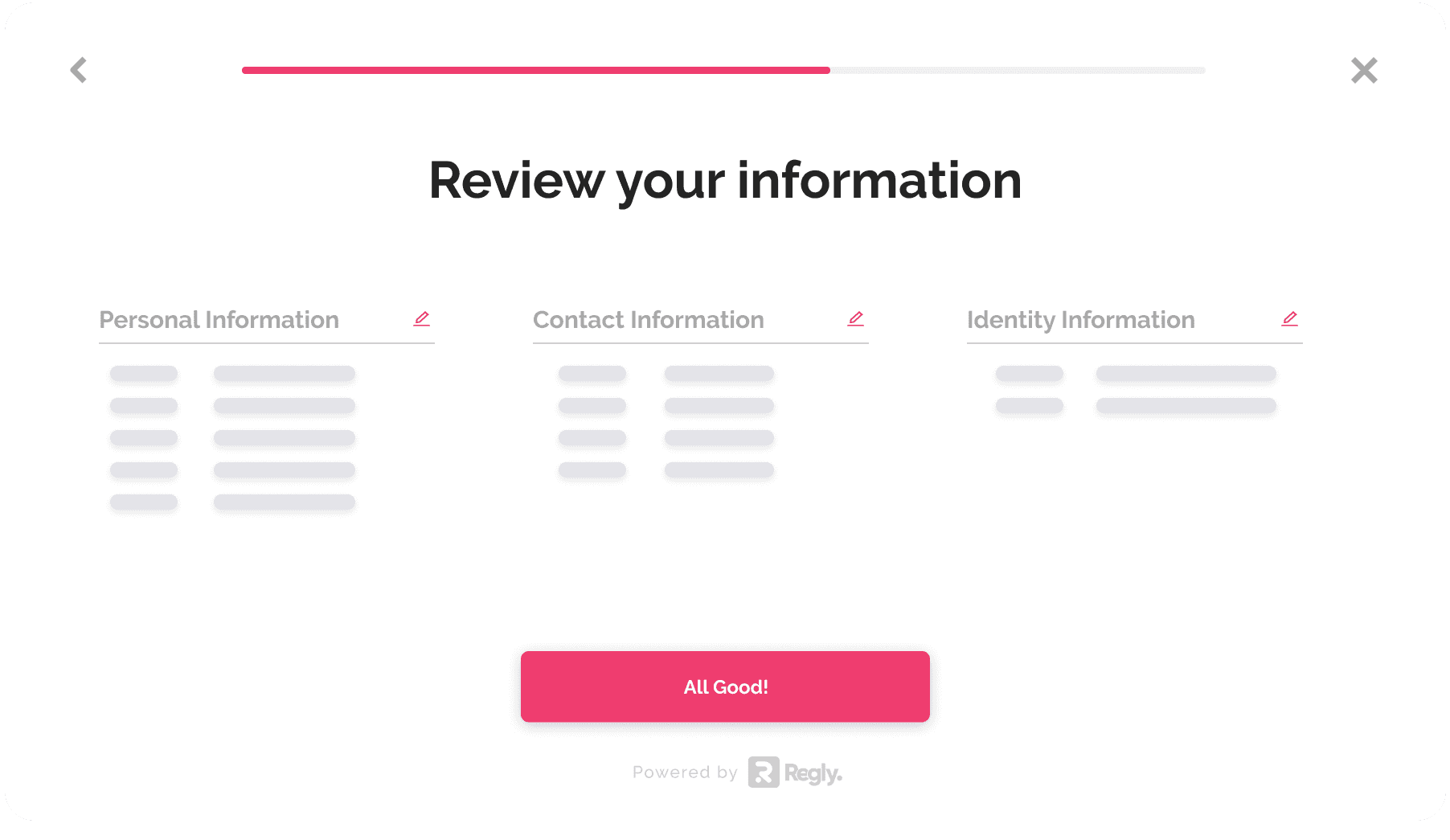

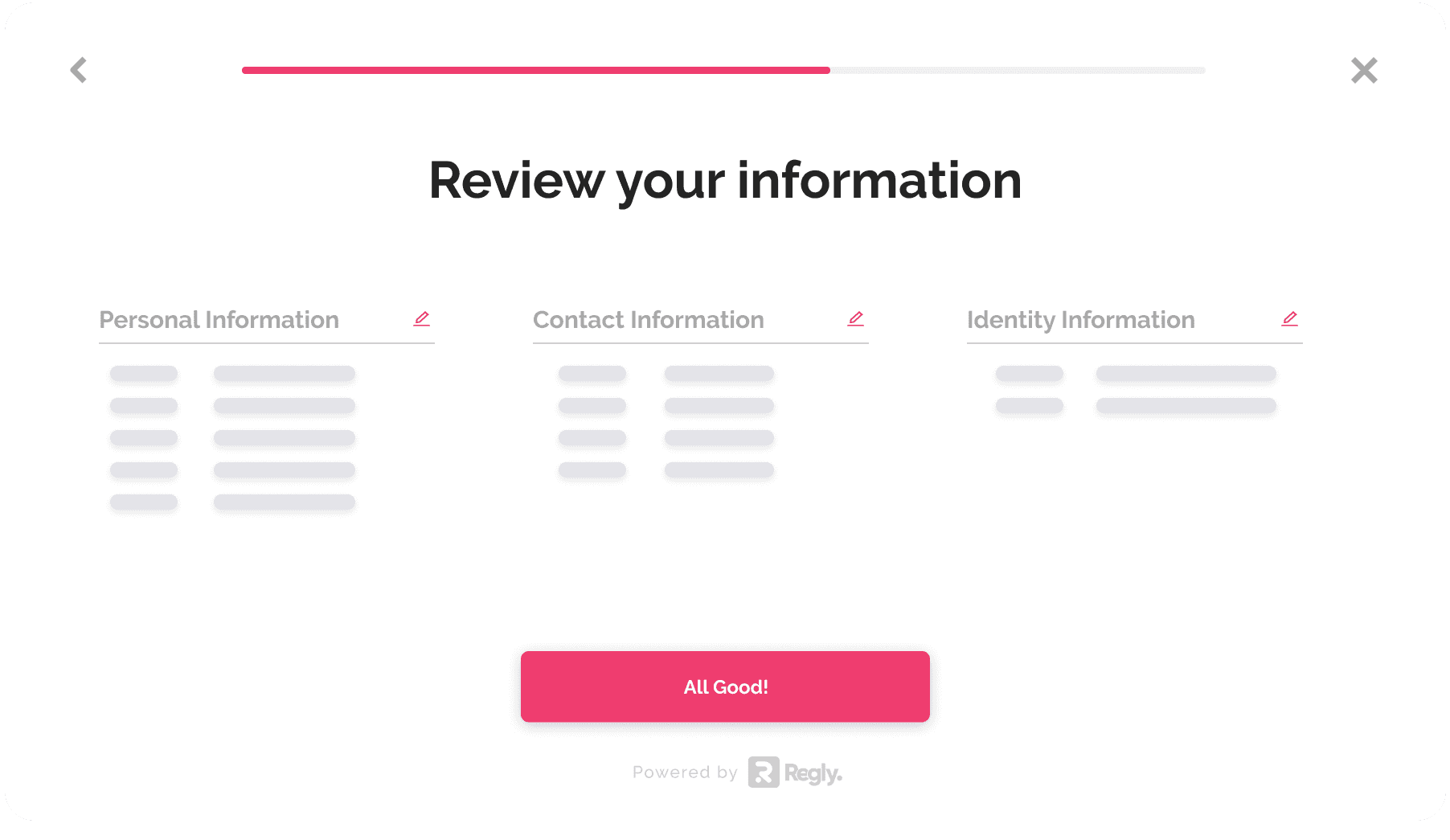

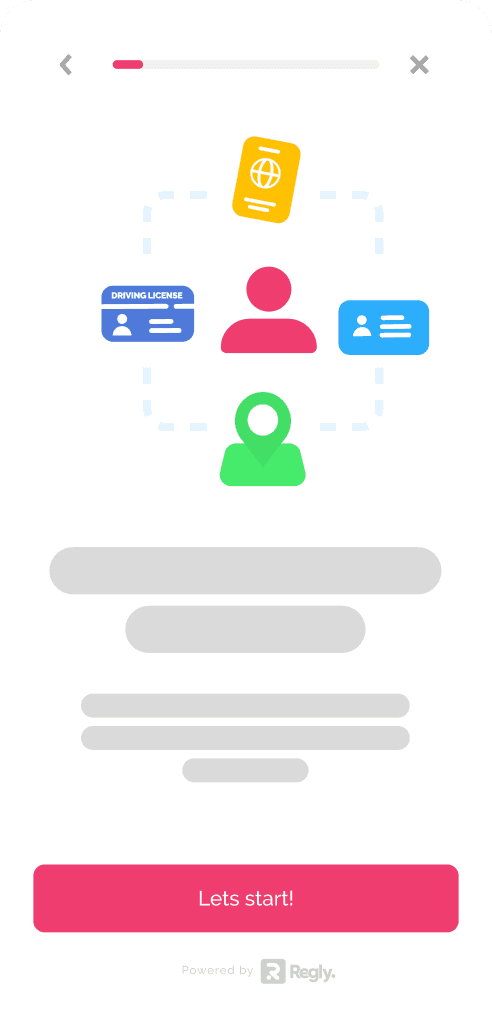

AI-Powered KYC and KYB

Verify customers and businesses with AI-driven tools that automate identity checks, document authentication, biometric analysis, and UBO identification for onboarding new users.

AI-Powered KYC and KYB

Verify customers and businesses with AI-driven tools that automate identity checks, document authentication, biometric analysis, and UBO identification for onboarding new users.

AI-Powered KYC and KYB

Verify customers and businesses with AI-driven tools that automate identity checks, document authentication, biometric analysis, and UBO identification for onboarding new users.

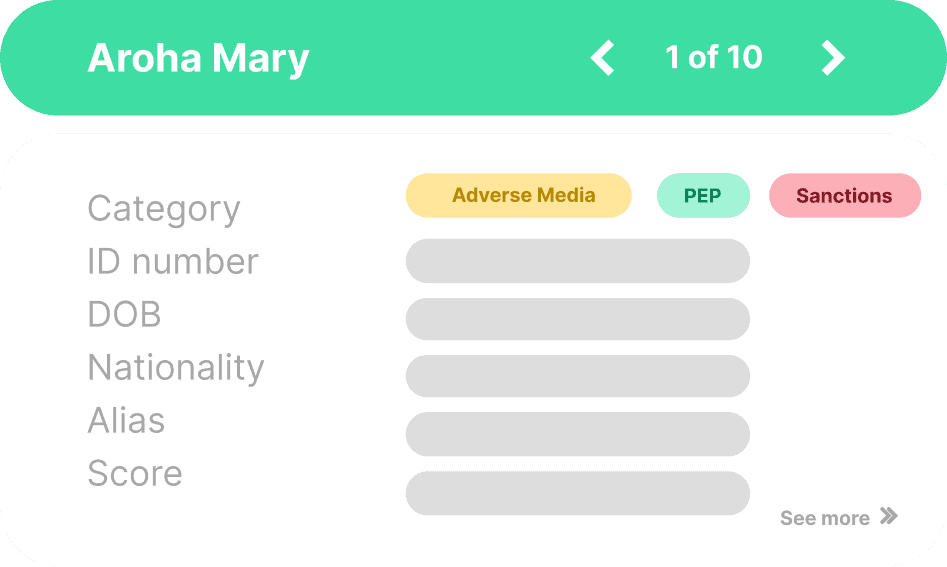

AML Screening

Streamline compliance efforts with automated sanction checks, PEP identification, and adverse media monitoring, powered by AI for faster, more accurate risk detection.

AML Screening

Streamline compliance efforts with automated sanction checks, PEP identification, and adverse media monitoring, powered by AI for faster, more accurate risk detection.

AML Screening

Streamline compliance efforts with automated sanction checks, PEP identification, and adverse media monitoring, powered by AI for faster, more accurate risk detection.

Risk Scoring

Evaluate risks with dynamic scoring that analyzes customer behaviors, transactions, and geographic data, helping teams prioritize threats with precision and efficiency.

Risk Scoring

Evaluate risks with dynamic scoring that analyzes customer behaviors, transactions, and geographic data, helping teams prioritize threats with precision and efficiency.

Risk Scoring

Evaluate risks with dynamic scoring that analyzes customer behaviors, transactions, and geographic data, helping teams prioritize threats with precision and efficiency.

AML Transaction Monitoring

Detect suspicious activities in real time with AI-driven transaction monitoring, using customizable rules and alerts to adapt to your business needs.

AML Transaction Monitoring

Detect suspicious activities in real time with AI-driven transaction monitoring, using customizable rules and alerts to adapt to your business needs.

AML Transaction Monitoring

Detect suspicious activities in real time with AI-driven transaction monitoring, using customizable rules and alerts to adapt to your business needs.

Industries

Who We Help

We transform your compliance operations and monitoring across regulated and non-regulated industries.

Financial services

Financial services

Fintechs

Fintechs

Crypto/Web3

Crypto/Web3

Broker-Dealers

Broker-Dealers

P2P market

P2P market

Ecommerce

Ecommerce

Crowdfunding

Crowdfunding

Forex Brokers

Forex Brokers

Lenders

Lenders

Investment Advisors

Investment Advisors

Money Transmitters

Money Transmitters

Our Story

Why Regly?

Why Regly?

Why Regly?

Regly isn’t just another compliance software. It’s the result of over a decade of hands-on experience in the world of regulatory compliance.

Born out of InnReg, a compliance consulting and outsourcing firm trusted by 100+ fintech companies since 2013, Regly was built to simplify complex compliance challenges.

Not all AI is built for compliance. We’ve trained Regly’s proprietary AI models on actual data from years of hands-on experience with regulatory exams, compliance reviews, policies and procedures development, risk mitigation, and more.

This is compliance software built by compliance experts, designed to make compliance accessible to everyone.

Regly isn’t just another compliance software. It’s the result of over a decade of hands-on experience in the world of regulatory compliance.

Born out of InnReg, a compliance consulting and outsourcing firm trusted by 100+ fintech companies since 2013, Regly was built to simplify complex compliance challenges.

Not all AI is built for compliance. We’ve trained Regly’s proprietary AI models on actual data from years of hands-on experience with regulatory exams, compliance reviews, policies and procedures development, risk mitigation, and more.

This is compliance software built by compliance experts, designed to make compliance accessible to everyone.

Regly isn’t just another compliance software. It’s the result of over a decade of hands-on experience in the world of regulatory compliance.

Born out of InnReg, a compliance consulting and outsourcing firm trusted by 100+ fintech companies since 2013, Regly was built to simplify complex compliance challenges.

Not all AI is built for compliance. We’ve trained Regly’s proprietary AI models on actual data from years of hands-on experience with regulatory exams, compliance reviews, policies and procedures development, risk mitigation, and more.

This is compliance software built by compliance experts, designed to make compliance accessible to everyone.

100+

100+

100+

Fintech companies contributed real-world insights that shaped Regly’s AI models

Fintech companies contributed real-world insights that shaped Regly’s AI models

Fintech companies contributed real-world insights that shaped Regly’s AI models

30+

30+

30+

Global regulatory experts built Regly with compliance and fincrime expertise

Global regulatory experts built Regly with compliance and fincrime expertise

Global regulatory experts built Regly with compliance and fincrime expertise

2+

2+

2+

Years of development focused on rigorous real-world testing before launch

Years of development focused on rigorous real-world testing before launch

Years of development focused on rigorous real-world testing before launch

Ready to Get Started?

Schedule a demo today and find out how Regly can help your business.